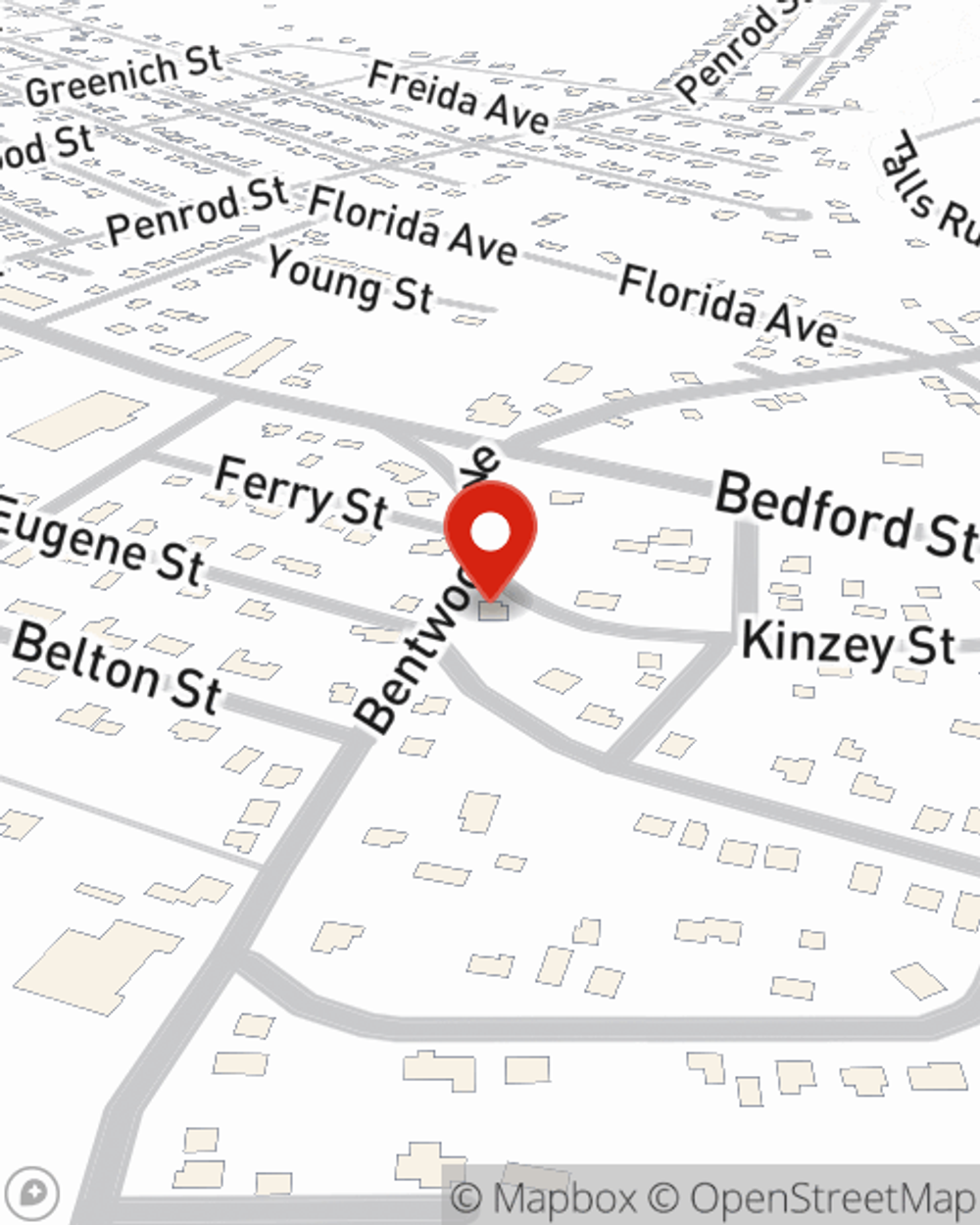

Business Insurance in and around Johnstown

One of Johnstown’s top choices for small business insurance.

Almost 100 years of helping small businesses

Insure The Business You've Built.

The unexpected happens. It's always better to be prepared for the unfortunate problem, like a customer hurting themselves on your business's property.

One of Johnstown’s top choices for small business insurance.

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like worker's compensation for your employees or errors and omissions liability, that can be created to develop a customized policy to fit your small business's needs. And when the unexpected does happen, agent Bill Weber can also help you file your claim.

Don’t let fears about your business stress you out! Contact State Farm agent Bill Weber today, and discover how you can benefit from State Farm small business insurance.

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Bill Weber

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.